Company Formation Costs Accounting Treatment

The question I think is about the. Ad Compare Find The Best Business Accounting Software.

Accounting For Startup Costs How To Track Your Expenses

Formation Expenses means inter alia legal fees duties including without limitation stamp duties listingand regulators fees registration and incorporation costs printing and Listing.

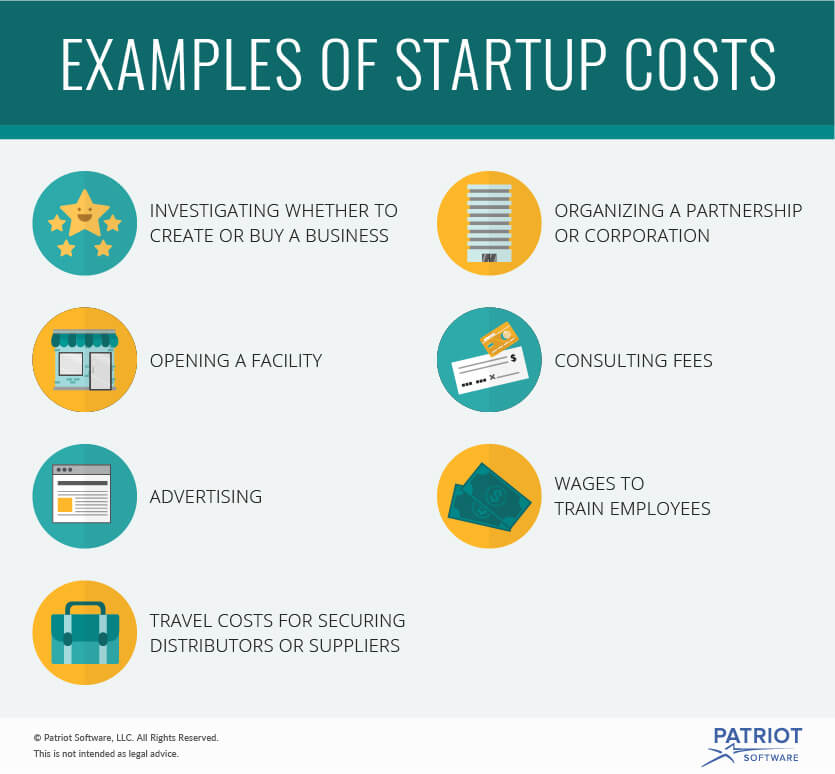

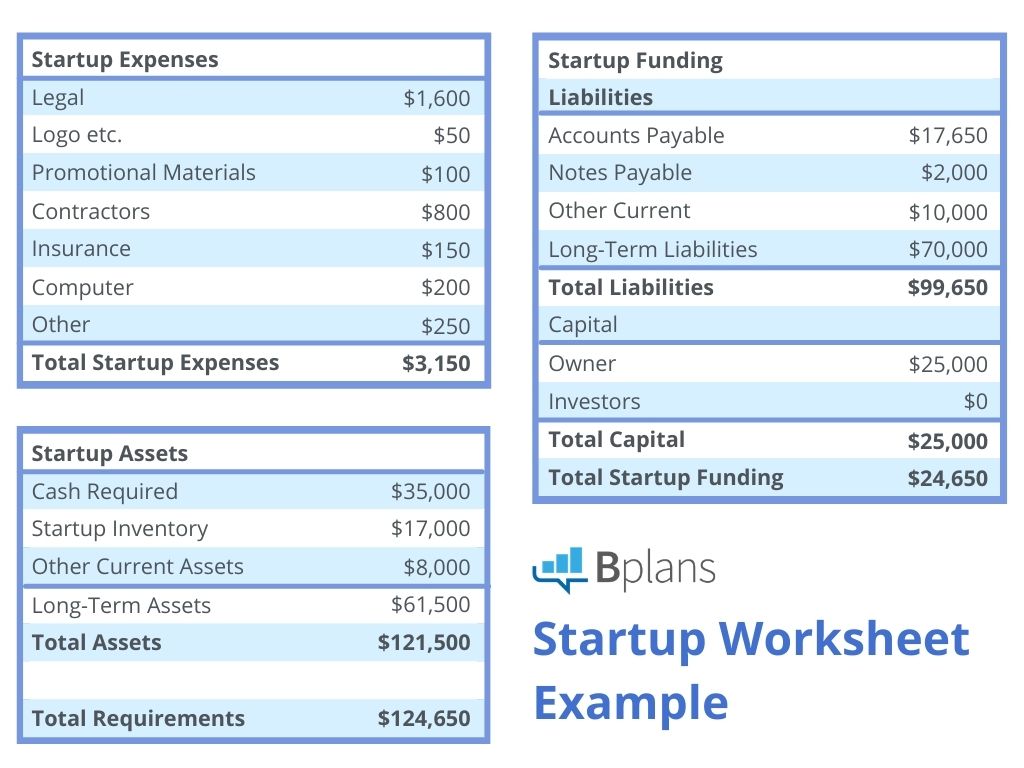

. Ad Well do the legwork so you can set aside more time and money for your business. Ad Get Products For Your Accounting Software Needs. You will likely lump all startup costs together into the same category.

LegalZoom--the 1 choice of small business owners for online business formation. Get Complete Accounting Products From QuickBooks. I have queries about company set up feesCan company s.

C Cost of printing of the memorandum and articles of. In tax accounting you can claim your organization costs as a deduction but separate from Section 195 startup costs. Ad Get Products For Your Accounting Software Needs.

You wont break the costs down into smaller. B Fees for registration of the company. Accounting treatment of establishment expenses Establishment expenses are all necessary to establish an establishment a company or a factory until it acquires a legal entity.

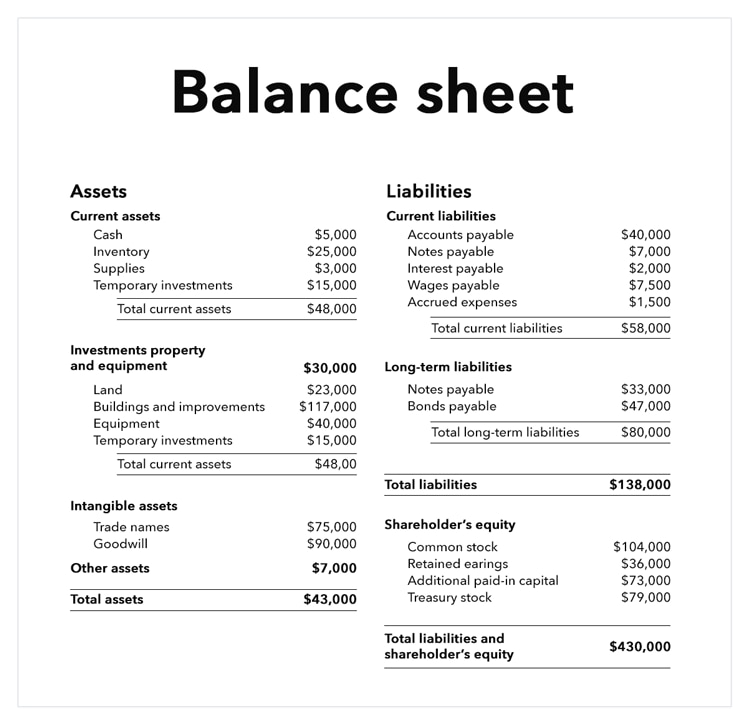

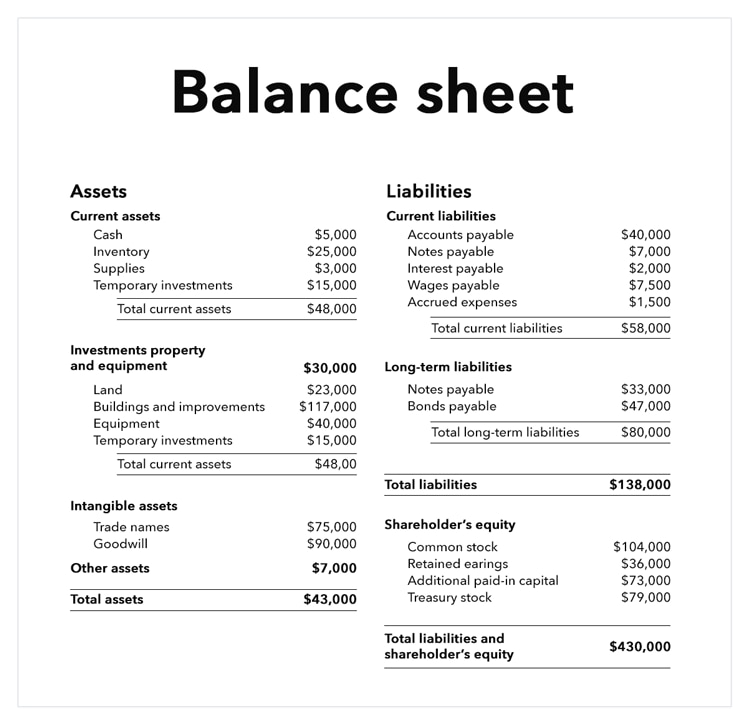

Valuation of shares and intangible assets. Legal costs of formation were traditionally treated as an asset and then systematically amortised over an arbitrary period. However there are no future economic benefits to be gained from.

For trees established from 1 July 2012 you can claim up to 7 of the cost of establishing the trees in each year worked out using the following formula. Ad Incorporate your company with confidence. Get Complete Accounting Products From QuickBooks.

The Companies Act Schedule VI provides for recognition of 15th of the total preliminary expenses each year for five consecutive years. Legal costs of. Get A Free Trial Now.

Establishment expenditure Write. Quickly Easily Form Your New Business in Any State For as Little as 0 State Fees. Before the determination can be made as to the appropriate accounting treatment of these costs the advisor or sponsor must first state its intentions regarding whether or not they would like.

To record this transaction following. Over 5000000 clients served since 2004. Like Section 195 expenses you can claim 5000 of.

100s of Top Rated Local Professionals Waiting to Help You Today. Company Formation expenses. Hi EverybodyCompany set up fees are non tax deductable and are capital costs.

Holding and subsidiary companies - accounting treatment and disclosures. A Legal cost in drafting the memorandum and articles of association. Expense related to Registration of a Company is treated as preliminary expenseLicense fee and Licence renewal yearly is a Indirect expense but the payment is for1.

Get It Right The First time With Sonary Intelligent Software Recommendations. All startup costs are treated the same way for accounting. Hi Right I know Formation costs are not an allowable expense when calculating Sch D1 Trading profits for Corporation Tax.

Accounting Formulas 8 Accounting Equations Every Business Owner Should Know Quickbooks Global

10 Finance Resume In 2022 Finance Jobs Finance Project Manager Resume

How To Estimate Realistic Business Startup Costs 2022 Guide Bplans

No comments for "Company Formation Costs Accounting Treatment"

Post a Comment